EasyReco is a cutting-edge automated reconciliaton system designed to catch, resolve and reduce discrepancies pertaining to order-level payments and returns. Featuring a centralized dashboard that populates data at SKU-level, EasyReco is suited to eCommerce businesses of any size and highlights any errors that might have occurred while matching your payments, returns, tax. With inbuilt advanced data analytics for reviewing profitability, EasyReco is trusted by thousands of entrprise sellers for its accuracy and is rated as the best payments and returns reconciliation tool available in the market.

With the expansion of business, increases the complexities of managing it efficiently. You need to have a technology that can streamline the business process so that you can concentrate on the most important thing for a business owner and that is growing your business. When you deal with the fast paced business world, you need to have competitive edge over your competition with faster delivery, best price and robust analytics.

Easily reconcile your accounts with EasyReco and ensure all eCommerce transactions are accurate. Get statuses on disputes raised and charge reversal claims accepted. The reconciliation of your historical data with the retro reconciliation tool gives you insights into your previous transactions and the profit, losses at hand.

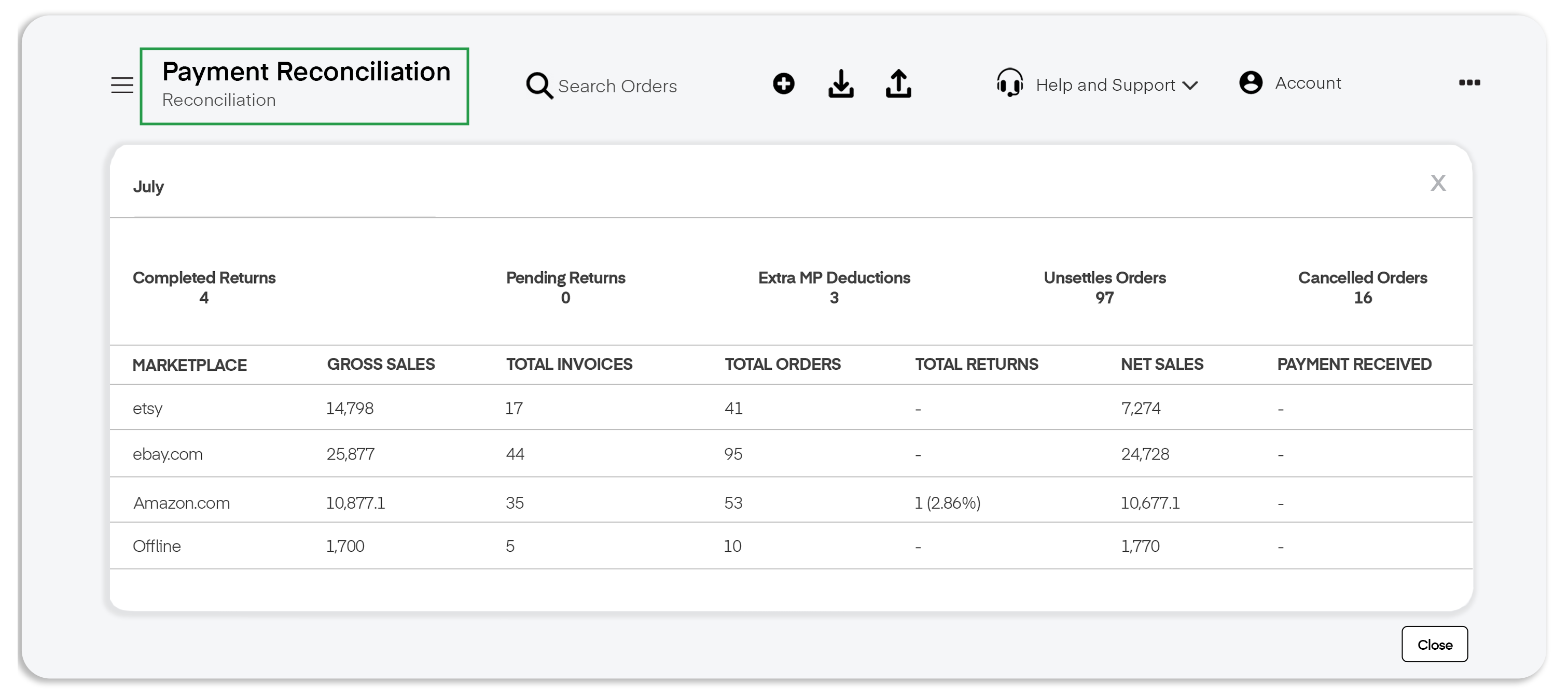

Reconcile payments against missed, pending or DNE returns and ensure appropriate charges are levied. Perform returns counts matching actuals with expected returns across distributed marketplaces. When the manual intervention is limited, the entire process becomes cost-effective and time-saving.

EasyBooks tracks the extra marketplace deductions like sales commission, logistics, payment gateway fee, and other charges, and generates a comprehensive order-wise difference report. You can claim these extra deductions from the respective marketplaces.

The live return tracker shows the pending returns on a real-time basis. It fetches data from across the marketplace portals and gives a consolidated returns report for you to take any action necessary.

Based on the monthly tax report, the automated tax engine provides you with the exact amount to be paid as tax on sales along with the amount to be claimed as sales returns.

Determine best selling inventory and maximize inventory performance to upscale profits. Analyze profits at an order-level to know which products are making you money, and can meet peak demand.

EasyReco offers order-level information on payment and returns leakages, inventory profitability and price slab deviations between actuals and expected.

While the dashboards are unique, EasyReco is a value-add on offering that can be billed to your existing account to unlock instant access.

EasyReco reconciles all marketplace fees across WooCommerce, Shopify, Amazon, Flipkart, etc.

No, records can be fetched for the past 30 days from the date of going onboard EasyReco. Record importing capabilities from prior tools is currently unsupported and will need to be backed up from the seller's systems.